The ultimate guide to Buying an existing hosting business

A hosting business can be a great investment, but unless you're aware of the risks and how to avoid them, your new venture may end up in shambles.

On this page

- Why buy a hosting business?

- Finding deals

- Specialized or broad?

- Search our Marketplace

- Unlock the listing

- Researching

- What's included in the sale?

- Do your due diligence

- Prepaid expenses and subscriptions

- Recognize low-hanging fruit

- Seller commitment

- Other things to consider

- Making an offer

- How much is the business worth?

- Bidding on a listing

- Closing the deal

- Arranging payment

- Using an escrow service

- Migration

Whether you're just starting out or you're already a seasoned entrepreneur, there are a lot of things to consider before purchasing a hosting business.

This blueprint walks you through the entire process, from conducting thorough research to communicating with and arranging payment with the seller.

Why buy a hosting business?

Before we begin, let's talk about why you would even buy a business in the first place. The obvious reason why buying an existing business is so popular is that you get to skip past some of the pain points and costs of starting a new hosting business completely from scratch.

Especially in a competitive industry like web hosting, it's difficult to get initial traction, and it can often take months or even years to make a profit.

Starting out with an existing brand and paying customers gives you a head start and a much better chance at success. As long as you keep taking good care of your clients, the recurring revenue will continue to accumulate over time.

Finding deals

Specialized or broad?

Before you start researching businesses for sale, you need to decide whether you want to offer general-purpose hosting or a specific niche service. Generic hosting has a larger market, but the space is also more crowded and requires more effort from a marketing and sales perspective.

Niche hosting, on the other hand, caters to a specific industry, segment, or user group. This lowers the overall market size, but the cost of acquiring a customer is usually lower because your targeting can be laser focused.

Either way, make sure you fully understand the target customer profile of the business you're researching.

Search our Marketplace

Visit the Host Flippers Marketplace to find a business that is within your target price range. Most businesses are valued based on a multiple of their monthly recurring revenue (MRR), but additional factors such as the age of the business, profit margins, and whether the sale includes a well-established domain name can contribute towards a higher price.

Unlock the listing

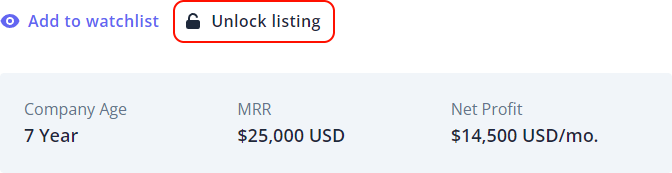

Basic information about the business, such as the MRR and the seller's description, is publicly available, but in order to get access to financial reports and confidential information, you need to unlock the listing.

Unlocking the listing shows commitment towards the seller that you're serious. It's how we weed out non-serious buyers and tire kickers, which helps improve the overall quality of our marketplace.

The first time you unlock a listing, you'll be required to fill out your personal details to verify your identity and sign a Non-Disclosure Agreement (NDA). By signing, you agree not to disclose any confidential information about the business that's uncovered during the due diligence process. This protects the seller in case you decide to not buy the business after reviewing all the information.

Luckily, this process only takes a few minutes, and once done, you'll be able to view detailed information about the business, ask the seller questions, and submit offers.

Researching

Once you've found a listing you're interested in, it's crucial that you take your time to review the information and learn enough about the business to make sure this purchase is right for you.

What's included in the sale?

Sometimes the owner wants to sell the entire business with all equipment, staff, and brand included, while in other cases, only the client base is included. Make sure there's no confusion regarding which assets are included in the sale to avoid problems later.

If you already have a brand or business with existing infrastructure, servers, etc., it may be beneficial to transfer the clients instead of keeping the acquired business as a separate entity.

Also, it might be wise to make sure the type of products and services on offer aligns with what you're already familiar with or using, unless you're planning to expand into a new market or segment.

Do your due diligence

Due diligence is the process of gathering as much information and insight as you can before buying a business, and it's a critical step on your path to becoming a new business owner.

Most likely, you're in this to make money, so it's important to get a good understanding of how the business is doing financially.

What are the top income-generating activities?

Are there multiple revenue streams or product lines?

Look at the revenue and cash flow today and over the last couple of months to determine if the business is healthy.

Is it growing month-over-month, or is it declining?

Is the revenue consistent or does it fluctuate a lot?

Just keep in mind that the fact that a company isn't growing doesn't mean it's a bad deal. It can still have a lot of unleashed potential, but maybe the owner has abandoned it and is not giving it the attention it needs.

We've seen countless examples of how a bit of effort and renewed motivation can turn things around and make a business prosper.

Make sure to use the profit and loss statement and other documents provided to verify the numbers and claims made by the seller. If you don't have any technical or financial knowledge, consider working with an accountant and lawyer to make sure you have all the information you need to move forward.

Prepaid expenses and subscriptions

Find out if there are any long-term leases or contracts that are already paid for in advance. Ask the seller to provide a renewal schedule for all software, servers, and so forth that are required as part of the daily operations.

It's important to make an agreement with the seller upfront on how such contracts should be handled if the business is going to be acquired midterm.

Recognize low-hanging fruit

While reviewing the business finances, try to look for untapped opportunities or ways to reduce the operating expenses. If you're able to run the business more efficiently or cut unnecessary costs, that's a quick way to increase profitability. Maybe you can leverage your existing network or skills to improve the sales process and propel the business forward?

Seller commitment

It's common for the seller to be available for a certain period after the sale to answer questions and help with a smooth transition.

Be sure to clarify with the seller beforehand how much time and support you can expect to get.

Other things to consider:

What are the customer demographics?

How many customers are there, and where are they located (if relevant)? Fewer, higher-paying customers often require less work and support than many smaller ones. On the other hand, it makes you more vulnerable to churn.

Do customers know they're being sold?

It's important to be open and communicate clearly to customers what's about to happen and what they can expect. The last thing you want is for half of the user base to leave after a week.

How much work is needed?

Whether you're doing this full time or on the side, make sure that you can devote enough time to the daily operations of the business.

What's the average churn?

Churn describes how many customers are lost per month versus how many new customers are gained. A high churn percentage can be an indicator of low customer satisfaction.

What's the reputation of the business?

What do existing customers say? Search online for reviews and customer testimonials to get a sense of the overall satisfaction rating.

Why is the business being sold?

There are plenty of reasons a business owner might put their business up for sale, including something as simple as an innocuous lifestyle choice like retirement. Or, there might be a more worrisome reason, like a fundamental problem with the business. If you're about to buy a business, you'll want to know exactly why the businesses you're considering are no longer working for their current owners.

If at any point you have a question, you can use the "Contact seller" feature to send a message to the seller. You may also reach out to the Host Flippers agent responsible for the listing, and we'll work with you to get the information you need.

Making an offer

So you've done your research and due diligence process. The numbers add up and you want to move forward with the opportunity. Luckily, the Host Flippers platform provides all the tools you need to submit your offer and communicate with the seller.

How much is the business worth?

But how do you determine the value of a hosting company? According to our research, most hosting businesses are sold for anything between 10x – 20x of their monthly recurring revenue (MRR). However, the actual market price will depend largely on the context and specific attributes of the business, such as:

- Age and reputation: an established business with happy customers and a proven track record is worth more than a startup.

- High profit margins: how much of the revenue do you actually keep? You should aim for a profit margin of at least 30% unless there is very high volume.

- Domain and brand: does the business have a short, memorable domain name? Brand recognition is important and hard to replicate.

- Location: companies based in the US or the UK are generally priced higher, but this may not apply if you're targeting a local market.

- Churn rate: what is the average lifetime of a customer? Companies that are able to retain their customers for longer provide a more stable income and tend to be valued higher.

- Future projections: does the business have high potential for growth? Be prepared to pay more for a business on an upward trajectory.

Bidding on a listing

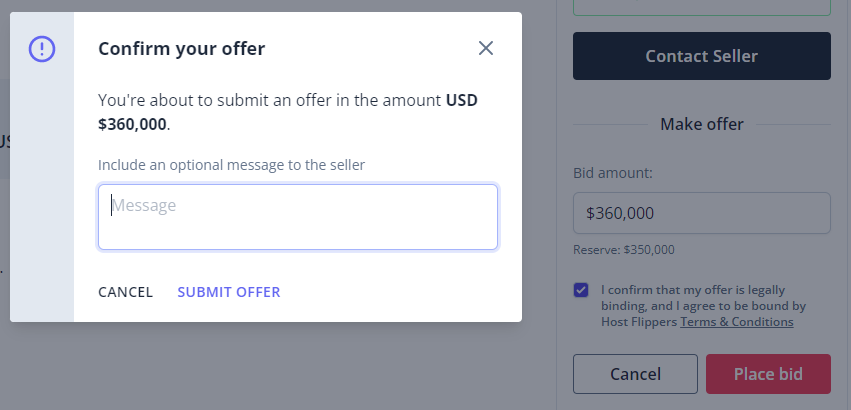

Once you've unlocked a listing, you're able to make offers on the business. Your offer amount can be lower than the seller's asking price, but some listings have a minimum reserve that acts as a lower threshold to prevent non-serious offers.

Public bids

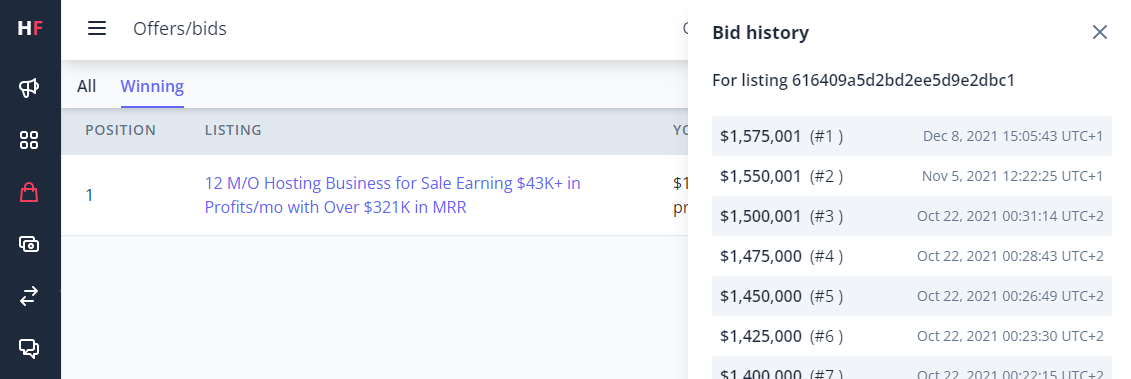

Host Flippers listings can utilize either a public or private (confidential) bidding system. If bids are public, then everyone can see the current highest bid as well as the bid history. Once a bid (offer) is received, the seller must wait a minimum of 24 hours before the bid can be accepted. During this period, the bid is circulated to all interested parties, and other buyers get the chance to raise their offers.

If another bid is submitted during this period, the deadline is extended accordingly. This ensures that the highest bidder wins and that everyone gets a fair chance.

The seller is free to reject any offer, but it's uncommon (bad manner) for a seller to reject bids above the asking price.

A bid must be raised by a minimum amount that is proportional to the current bid according to the following rules:

| Current bid amount | Minimum increment |

|---|---|

| < $1,000 | $50 |

| $1,000 – $9,999 | $250 |

| $10,000 – $99,999 | $1,000 |

| <$100,000 – $999,999 | $5,000 |

| $1,000,000+ | $25,000 |

Private/confidential bids

In a private bid listing, the current bids are confidential and only visible to the seller. Once you make an offer, the seller can choose to accept or reject it immediately, or make a counter-offer.

In both cases, when you submit an offer, it is final and legally binding. That means if the seller accepts your offer, you're obligated to buy the business for that amount.

Placing a bid

To place a bid, simply click on the "Make Offer" button and then enter your bid amount. Depending on how the seller has set it up, the listing might have a minimum reserve price.

Cancelling a bid

All bids are final and legally binding, but a bid can be canceled if the following conditions have been met:

- More than 72 hours have passed since the bid was placed.

- The seller has not accepted the bid.

Managing your bids

You can easily keep track of which listings you're bidding on from the Offers/Bids section in the Host Flippers Dashboard. If bids are public, you can see at which position your bid is, and you can also see your own bidding history on a particular listing.

Counter-offers

The seller may respond with a counter-offer if they think your bid is too low. In this case, we'll email you, and you can click on a link to place a new bid with the requested amount.

Normally, the bidding round goes back and forth like this a few times before the buyer and the seller finally settle on a price that is somewhere in the middle.

Closing the deal

If the seller accepts your offer, the listing will be immediately removed from our marketplace, and no other users will be able to bid on it. It's time to proceed to the most critical stage of the buying process: making the payment.

However, if you follow our simple steps, it will lower the risk of running into issues and later disputes.

Arranging payment

Make sure you and the seller agree on the terms of the transaction. Make a contract denoting the exact sales sum and what the purchase entails. Be specific about the deliverables and what is expected from each party (especially what is expected from the seller after the transaction).

Also specify how the payment should be made and who's responsible for paying the transaction fees.

Financing

The most straightforward method of financing a business acquisition is to pay all cash up front. This means that the seller receives full payment as soon as the transaction is completed.

In some cases, alternative financing options, such as partial seller financing, may be accepted. A portion of the purchase price is paid back over time, typically from the business's profits. This financing option exposes the seller to liability due to the lower down payment, but it may attract more bidders.

Using an escrow service

"How can I send money safely and be certain that I get what I pay for when I don't know the person on the other end?"

That is the most common objection people have when it comes to doing high-value transactions online.

The buyer needs assurance that they aren't being deceived, while the seller wants their money before relinquishing ownership of the business.

Instead of relying on good faith alone, we recommend always using an escrow service. An escrow agent acts as an intermediary to protect both the buyer and the seller.

Typically, the seller or broker sets up a dedicated bank account that is managed by a third-party accredited escrow agent. The escrow agent temporarily holds the funds until certain conditions have been met and the transaction closes.

An important feature of an escrow account is that neither the buyer nor the seller can withdraw funds from it.

How escrow works

The principles of an escrow transaction are very simple:

- The buyer and seller agree on the terms of the transaction

- The buyer deposits funds into the escrow account

- The seller is notified that the amount has been secured and transfers the assets and ownership of the business to the buyer

- The buyer inspects and accepts delivery

- Funds are paid out to the seller

Host Flippers has partnered with Escrow.com to provide a seamless experience when carrying out transactions through our platform. Escrow.com is an online, licensed escrow service registered in the State of California, USA.

As a buyer, you can be sure that you always get what you pay for. The risk of being scammed is removed as you never transfer money directly into the seller's bank account.

Migration

Once you've transferred the funds, the seller will begin the process of handing over all the assets and data that are needed for you to take control and ownership of the business. This includes things like server login credentials, customer records, and any additional information that is required to operate the business.

You will typically also need to switch out payment processors and other third-party integrations and replace them with your own. The amount of effort this takes depends on what type of software, etc., the business is using, but hopefully this is something you've already mapped out as part of your due diligence process.

The transaction now enters the inspection period, which usually lasts anywhere from 3 to 14 days. Use this time wisely to make sure you have received everything you require and that the business is 100% under your control before you accept the handover. At this point, the transaction will be closed and the funds will be released to the seller.

During the inspection period, the seller will be available and actively working with you to ensure that the process goes as smoothly as possible.

Congratulations! The new hosting business is now yours and will hopefully continue to pay dividends for years to come.